What is the Park City Market Sentiment Metric?

Real Estate Analysis - 6 Minute Read

1/31/2023(Updated 7/8/2023)

The Park City Market Sentiment Metric is a powerful tool for monitoring the trend in property prices. It is a single number that indicates the direction of change in the market and the speed at which prices are shifting. A positive number means that prices are shifting toward a positive direction, while a negative number means that prices are moving away from the positive direction. The larger the number, the quicker the rate of change in the market. This metric provides an easy and concise way to keep track of the market, giving you the information you need to make informed decisions about buying or selling property in Park City.

Park City Real Estate Market Report

A Park City market report is a summarized statistical review and general feel for the market. The sentiment metric presents a single number and historical values that simply summarizes the market conditions. A negative number implies the market conditions are weaker than prevailing opinion while a positive number means the market is stronger than expected. The trend graph illuminates the longer term market direction.

Park City Price Movements

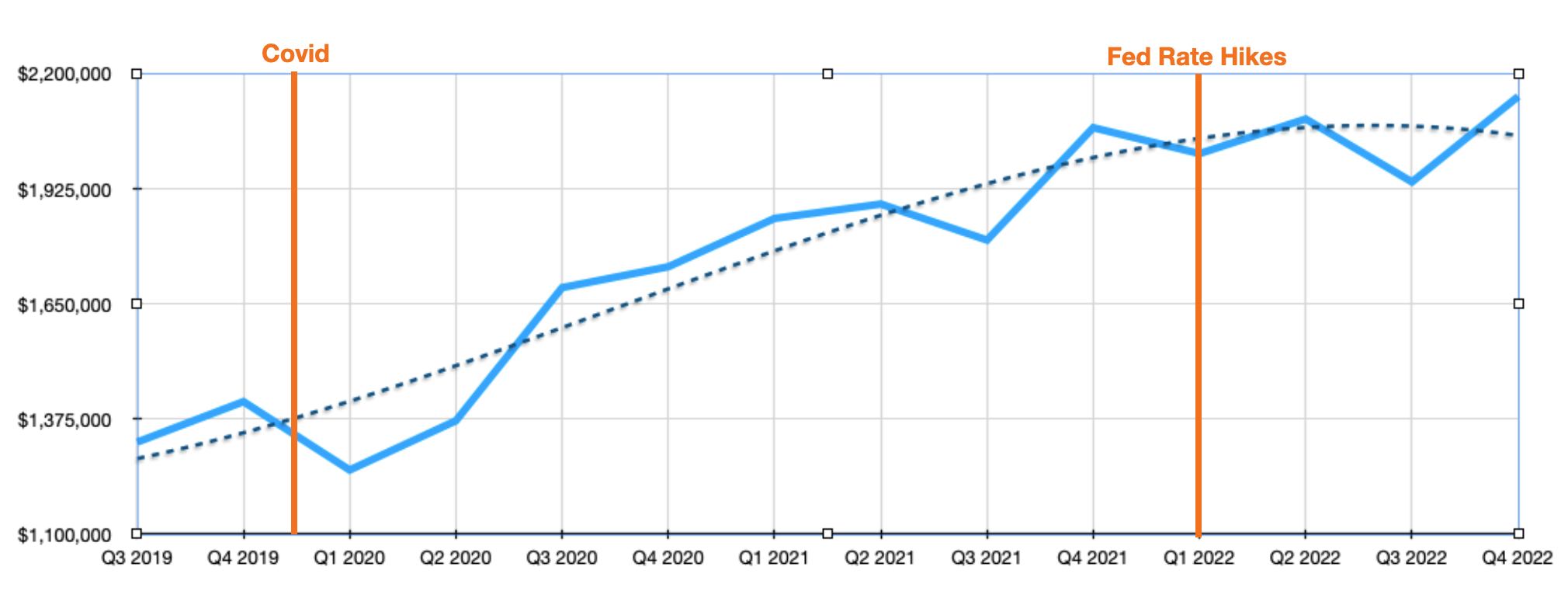

Let's use this four year chart of Park City proeprty prices to help illustrate the how the Market Sentiment Metric's works. The chart is designed to give a clear and concise picture of the market trend over time. The thick solid line connects the average price for all properties sold in each quarter, providing a clear picture of the overall market trend. A regression line is shown as a dotted line and it smooths out the noise of market data to reveal the underlying trend. This regression line helps to eliminate short-term fluctuations and provides a clearer picture of the overall market trend. Two significant market shifts are highlighted with vertical lines on the chart. The first line marks the start of the Covid-19 pandemic in March 2020, which had a significant impact on the market. The second line marks the Fed rate hikes in March 2022, which also had a significant impact on the market.

The Role of the Market Sentiment Metric

The role of the Park City Market Sentiment Metric is to "bend the regression curve" to account for the constantly shifting market. Regression lines smooth noisy data and so take time to adjust to rapid changes. Also, regression lines while good at exposing trends and not generally useful for predicting the future. The metric can be considered a predictor corrector for extending the regression line slightly into the future. For example, the start of the Covid-19 pandemic in March 2020 caused the average price to drop quickly, requiring a large negative metric value to bend the regression curve downwards. The subsequent 2-year boom during the pandemic, fueled by Fed stimulus, would result in a positive metric reading that would bend the curve upwards towards the market. On the other hand, the Fed rate hikes of 2022 caused a slowdown in the market, requiring a negative metric reading to bend the curve downwards.

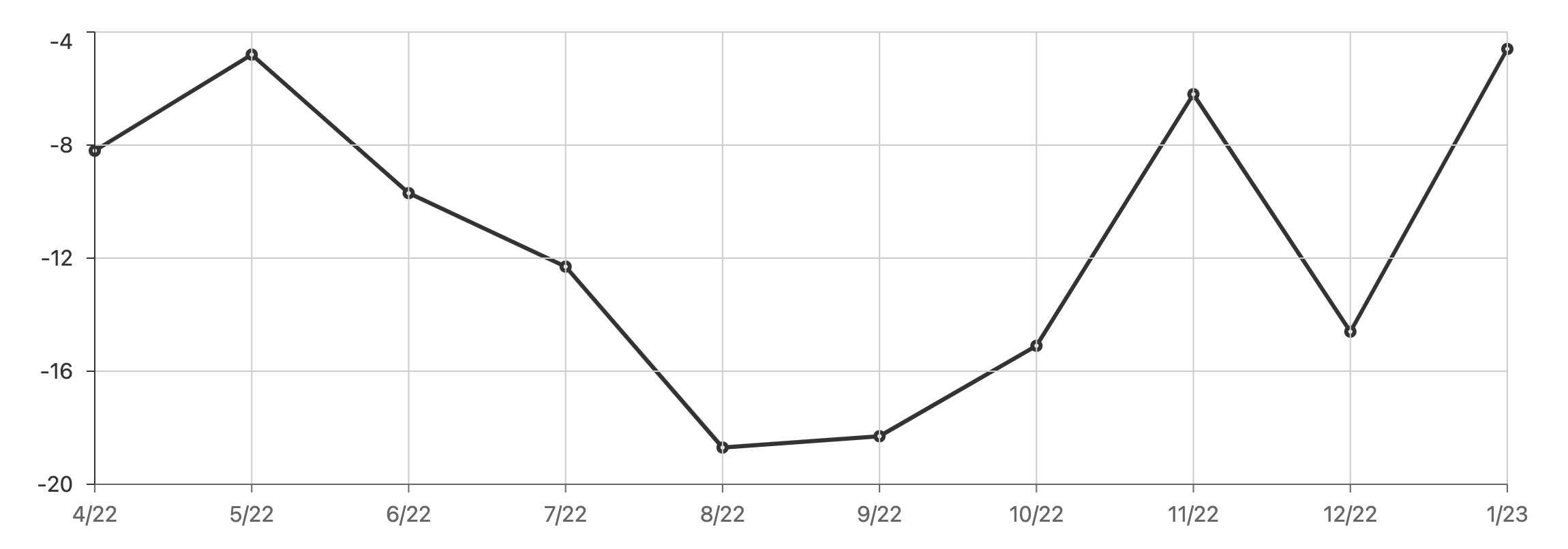

Here is a graph of the last 10 readings of the Market Sentiment Metric at the time of this post.

The graph of the last 10 months for the Park City Market Sentiment Metric shows that all readings have been negative, with the most negative reading of -18.7 in August 2022. This sharp decline in the metric was due to Fed action in March 2022, which caused the market to start decelerating and the Market Sentiment Metric had to quickly adjust to reflect this change. Since September 2022, the metric has been moderating and showing signs of improvement. Despite the negative readings in the Market Sentiment Metric, Park City real estate prices have continued to steadily increase over the past year. According to the data, average prices finished December 2022 4% higher than they were a year earlier, with the median sales price even higher, at a 6% increase. The Covid-19 price surge in Park City, like much of the US, was significant with a nearly doubling in prices in two pandemic filled years. The strong negative metric "bent the curve" away from these strong increases and towards more moderate market conditions.

Defining the Metric

The Park City Market Sentiment Metric is a number that expresses the momentum change of the Park City real estate market. The metric ranges from -100 to +100, with a typical range of +/-20. A positive number in the Market Sentiment Metric indicates that the market is bending towards increasing prices, whereas a negative number indicates that the market is bending towards decreasing prices. In a decreasing market, a positive number means that the rate of decline is decelerating, while in an accelerating market, a positive number means that the rate of increase is still accelerating. The Park City Market Sentiment Metric provides insight into the overall momentum of the market, which should not be confused with the direction of the market. Positive and negative numbers indicate the trend of prices but not the actual direction.

Looking Beyond the Headlines

Consider this quote about the US housing market:

Experts are predicting another 10% to 15% drop by the second or third quarter of 2023, according to multiple sources.

2023’s Housing Correction Could Be The Largest Since Post-WWII Yahoo News

Perhaps the article's dire prediction will come true in 2023. There are certainly plenty of buyers on the sidelines waiting for the crash later this year.

What is the data saying today?

- The Market Sentiment Metric shows a moderating trend towards neutral

- Price reductions are trending steadily down from a high of 48% listings in the summer to mid 20% range today

- Inventory levels have been flat for several months indicating a match between supply and demand

- Average and median prices continue to slowly increase

The data points to a market that has stabilized and gradually rising after rapidly rising during the Covid-19 pandemic and then rapidly declerated when the Fed started raising rates.

You can view many important Park City property market metrics to track the market and decide for yourself on the condition of the market.

A valuable tool for real estate investing

The Park City Market Sentiment Metric is a valuable tool for anyone interested in real estate investments and property ownership. By providing insights into the direction and pace of home prices, it helps investors and property owners make informed decisions and plan for the future. Whether you are a seasoned investor or a first-time homebuyer, the Park City Market Sentiment Metric is an essential tool for success in the real estate market.

Contact Slope Style For Free Estimates

Our team of experts has decades of experience buying, selling, renovating, flipping, and living in Park City and is committed to providing the most accurate and up-to-date information to our clients. If you're considering buying or selling a property in Park City, we invite you to give our estimator a try and see what we think a property is fairly valued. Additionally, if you're looking for a more in-depth estimate or want to strategize on what to offer for a property, contact us for a free in-person estimate. Our team is here to help you make informed decisions about buying or selling a home in Park City.